LAUSANNE - ZURICH - BASEL - BODENSEE - LUGANO

NEWS

THE FINANCING OF REAL ESTATE ABROAD

| Let's take France as an example |

| A bank finances local clients who are tax residents in Switzerland and own or want to buy a property in France as a second home : |

|

| Here is a brief summary of the tax consequences of acquiring real estate in France: |

| Direct ownership of the property offers advantages, simply, without legal and tax restrictions, to use the property. It also offers the flexibility to act directly on the property in the future, also the sale to a company if there is a need for liquidity. |

| TAX POLICY IN FRANCE |

| On acquisition, land transfer tax and notary fees can be around 7% for the purchase of an existing property and 2% for the purchase of a new building with VAT at 20%. |

| For income tax purposes, and in contrast to Swiss law, the rental value associated with the use of the property is tax-free in France. |

| However, furnished holiday rentals are subject to French income tax (between 20% and 45%), to which must be added social security contributions of 7.5% for those insured under the Swiss pension scheme, depending on the status of the landlord. The tax base depends on the accounting system of the furnished rental (Real or Micro-BIC) and the status of the landlord: LMNP (non-professional furnished landlord) or LMP (professional furnished landlord). |

| French real estate wealth tax (IFI) is due when the net real estate wealth (after deduction of real estate debts) exceeds the threshold of €1.3 million, the tax rate then varies between 0.5% and 1.5%. |

| Gift and inheritance tax in favour of children can theoretically be as high as 45% in France. This is the main concern of property buyers in France. " In reality, our cross-border wealth planning experts prove with figures that this rate is a myth when buying second homes in France ". |

| TAX POLICY IN SWITZERLAND |

| The property located in France is not subject to Swiss taxation. The rental value and rents are only taken into account when determining the income tax rate (KSt and dBSt) and the value of the property is taken into account when calculating the wealth tax rate (ISF). The bank debt and related interest, although used to acquire the property in France, may be partially deducted from Swiss income and wealth. |

| ACQUISITION THROUGH A SOCIETE CIVILE IMMOBILIERE (SCI) |

| The motives |

| The SCI, which is subject to the income tax system (semi-transparent), seems to be the most appropriate way to own a residence of enjoyment. Its tax and accounting outlays are lower in contrast to an SCI subject to the corporate tax system. |

| This company separates the ownership of shares as a shareholder from the decision-making power as a director over the articles of association. This protects the family from the disadvantages of possible joint ownership (common ownership). |

| Furthermore, it is an instrument to transfer debts to the children (in the hope of self-enrichment of the SCI) and thus reduce the tax base for gift and inheritance taxes. |

| The conditions |

| Income tax SCI is exclusively for owner-occupation of the property and excludes seasonal rental, which is considered a commercial activity, incompatible with the income tax system.Moreover, the effectiveness of the gift of SCI shares should be limited in time in the absence of rental income. This is because the donees could possibly inherit a shareholder account which is subject to inheritance tax in France. |

| Taxation of SCI |

| In France, the tax consequences of owning a user dwelling through an SCI are almost the same as the consequences of direct ownership. |

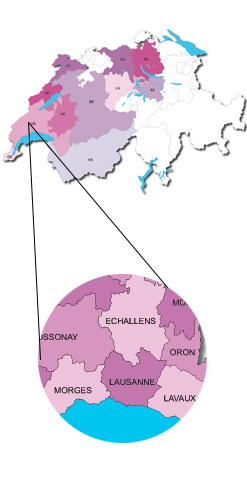

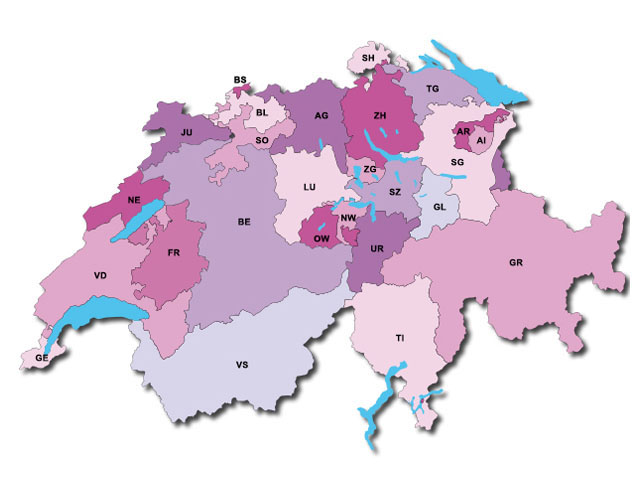

| From a Swiss perspective, ownership through an SCI could lead to cantonal tax consequences, especially in the canton of Vaud. |

| Is debt a tax issue? |

| The debt for the acquisition of a second home in France is first and foremost an economic issue that must be guided by a cost-benefit comparison. Certainly, the tax dimension can influence the cost of acquisition, but this must not blind the acquirer to the importance of being surrounded by cross-border experts capable of taking a global Franco-Swiss approach. |

| For other approaches and/or for other countries, we offer personalized advice. |

| ADDITIONAL INFORMATION |

| Contact us without any obligation. We offer you a solution-oriented flexibility, as well as a tailor-made accompaniment through your entire acquisition process of your international real estate projects. |

|

Informations

Acquisition in Switzerland

International real estate

Prestige properties

Our VIP services

Looking for a prestigious estate

Our Links

TissoT Real Estate Switzerland

TissoT Real Estate International

Links